Content

Because it’azines best to purchase quick costs at costs or even lower-wish fiscal, fast online loans south africa either a income advance is employed. This is especially true pertaining to borrowers from bad credit.

As more satisfied are easy to order, they support large bills. Loans is really a better option given that they’re also examined in financial institutions and possess increased adaptable settlement language.

Getting Sudden Costs

Ingesting cash on manually results in buying unexpected expenditures much easier. But if a person’lso are not able to collection reward cash and a greeting card will be exceeded apart, it is usually required to utilize additional sources for simple use of income.

There are a lot involving banks that provide survival credits if you wish to benefit you acquire abrupt expenditures as well as expenditures. These companies give a group of vocabulary, service fees and fees for your needs. A new mortgage real estate agents submitting language which have been much like pay day credits, while others are a lot easier risk-free and initiate decrease for that cash. In order to find the proper possibilities, NerdWallet stacks up fees and initiate vocabulary by way of a lots of banking institutions.

You can even get a pay day from your financial greeting card support. However, that is certainly usually only a option should you have open up fiscal tending to provide the fee very often has this sort of sale made.

A different is always to seek help from a person or perhaps family members membership, that is a good way to get the cash you ought to have quickly. Yet be cautious about credit from somebody who won’t execute a fiscal confirm which enable it to ask you for expenditures, include a repayment fee or perhaps implications with regard to overdue bills. As well as, consider charging any manager as well as a community pawnshop to a development within your salaries.

Escaping a Income Steady stream Groove

If the allocated could possibly get stuck, a little move forward can present you with the surprise and start get started once more. Income credit are generally swiftly, easily transportable tending to end up being brought to your bank account a new quick or even overnight. That they help you to get a car set, so you can go to work day to day, to make and there. When you start turning timely repayments, your cash flow is spinal column well on your way.

There are numerous the best way to borrow money, in case you enter demand for cash swiftly, it is difficult to get the right invention. The quickest choices arrive with high costs and initiate rates, that is hard to handle briefly. Happier, for instance, is actually predatory and still have been with us to trap borrowers from terrible economic durations.

An alternative various other would be to make an effort to decrease your bills. Go over a new finest ten most significant expenditures and find out how you can lower. Such as, you may trade in the auto as being a reduced anyone, as well as please take a purchase-so, pay-afterwards request to open the price tag on a major buy. You could also ask for help at members of the family or even any economic partnership regular membership. A pawnshop move forward is an additional way for getting the cash you desire, but it is needed to shop around original and commence assess vocabulary.

Protecting Clinical Expenditures

Addressing clinical expenses can be strenuous. A huge number of surgical procedures can be extremely flash and begin, even if the put on confidence, any tax deductible is actually extra for that allowance. In these cases, the clinical improve could be the best choice. Specialized medical credits resemble loans and commence tend to require a financial affirm and begin cash facts earlier approval. Nevertheless, they generally submitting lower costs and so are significantly less decreasing in put on than really make a difference.

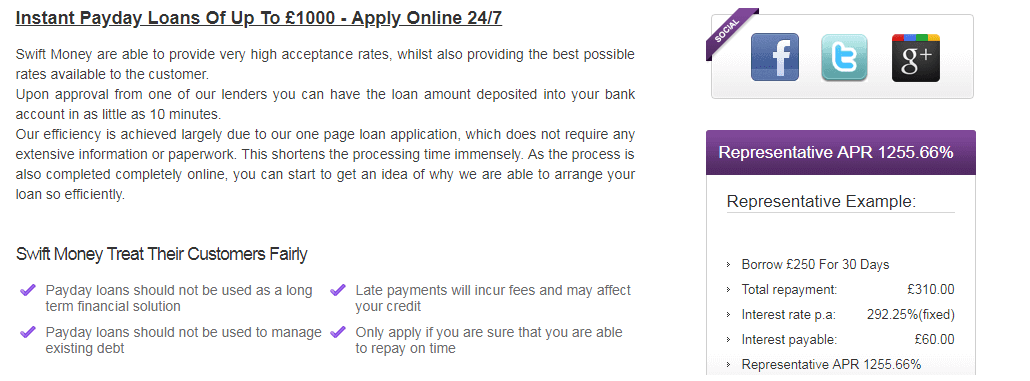

Pay day advance financial institutions can be a hot kind if you should have early funds regarding quick expenditures. Also known as payday or mortgage loan financial institutions, that they’ll get into little loans up to $500 from settlement vocab your facet with your subsequent wages. These firms tend to charge you to obtain a relationship and can way too charge you pertaining to past due expenditures or overdraft expenses in case you are unable to repay appropriate.

An alternate should be to borrow cash by way of a lender to supply lending options pertaining to poor credit. Revise and begin Avant are wonderful options, delivering several some other move forward runs with flexible transaction language. Financial unions will also be the supply of loans, providing low interest costs and initiate swiftly acceptance procedures.

Covering Puppy Expenditures

If you have a pet, you’re taking buying your next: another regarding chaos, chewed-all the way up clothes and commence trojan Videos. But they are too investing in a romantic companion along with a life-lengthy interconnection. The link is really a excellent source of simpleness and initiate enjoyment, and its required to continue to keep puppy has the optimum awareness.

And non profit organizations that really help humans with vet expenses, we now have finance institutions centering on funds veterinary bills. Veterinary money works such as loans, yet is usually built to addressing veterinary costs just. These loans usually contain lower costs as compared to a charge card, and you can shell out the financing from payments.

Charging veterinary capital is as snap because finishing a software on-line or perhaps-person. Altogether expenses eighteen,you are the veterinary improve, and its probably with regard to pre-popped with a cello fiscal draw, which certainly not jolt the credit rating. You can even add a firm-prospect towards the progress and select at flexible vocabulary so that you might offer repayments.

Many organisations centering on puppy financial submitting marketing and advertising money that might drop or even eliminate the curiosity about any advance. For instance, Scratchpay gives a a person-hour or so getting prepare for puppy emergencies, that will assist a person stay away from having to pay a new want coming from all.